We're here to make Investing Smart & Customised to your needs

Get Advice on How to Reach Your Financial Goals.

Paperless | 100% Secured | Zero Fees | Simple

Truly a Wealth-Tech Company

-

States where our clients are based

-

100% Paperless

Serving Clients Across India

How it works?

Build

We'll help you build an investment portfolio that perfectly syncs with your goals & risk profile.

Manage

We'll continuously monitor your portfolio & suggest changes as per market scenario. All you have to do is click to approve.

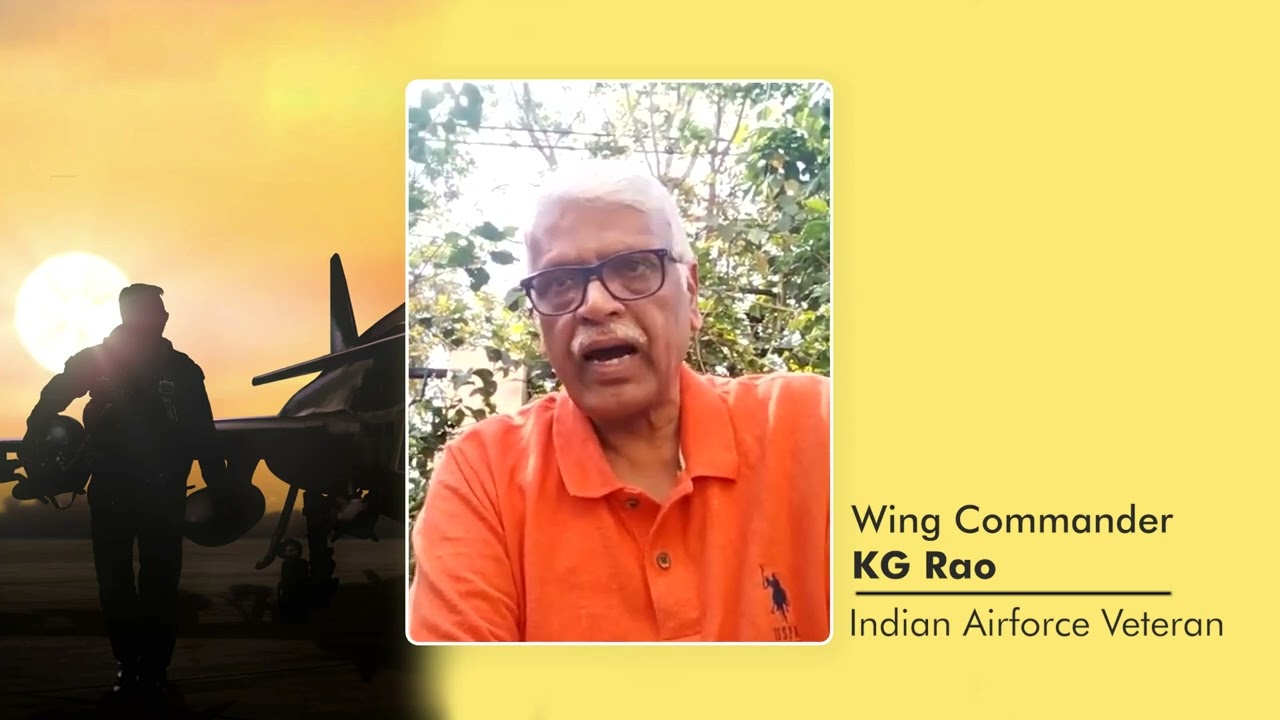

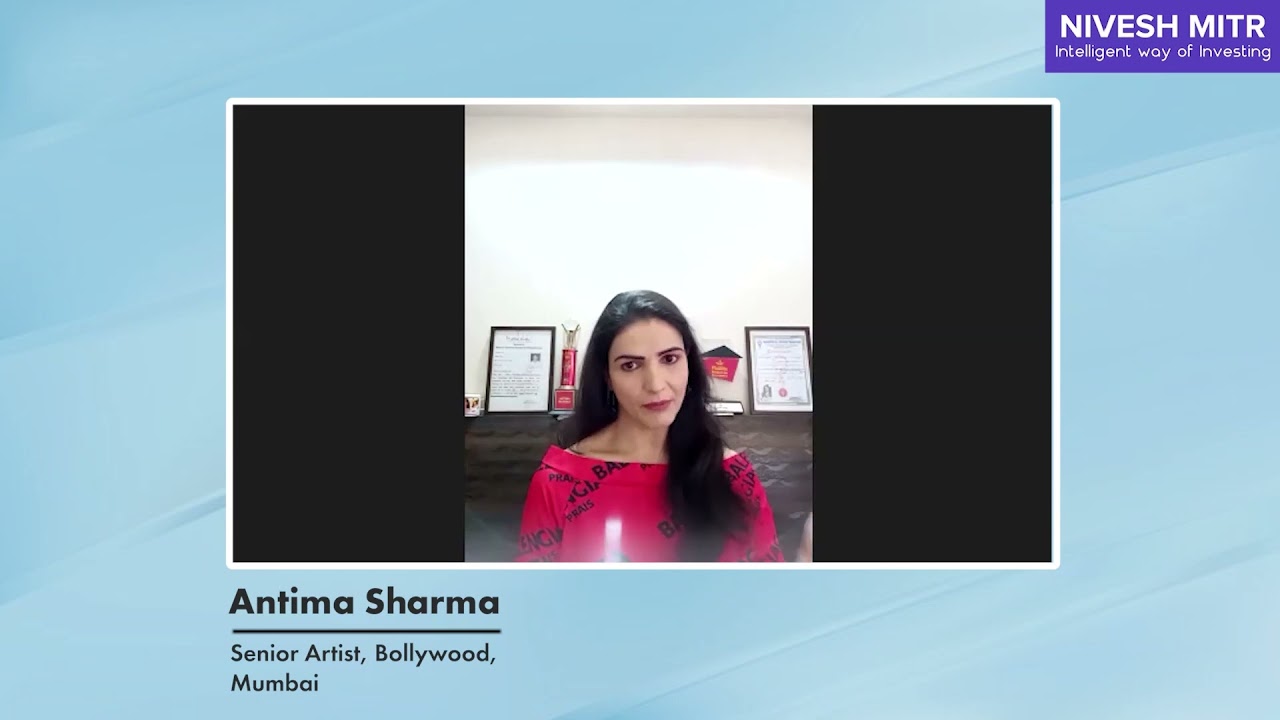

We have access to one of the best investment strategists in the business. View our interactions with industry experts below -

Why invest with Nivesh Mitr?

Smarter Investing

Invest and redeem with just a click 24*7.

And get access to smarter financial planning tools to help you invest confidently for your future.

Family accounts

Investments of spouse, parents, children - all managed at one place so you can manage money more efficiently.

100% Secured

We take security very seriously. Your funds are routed through the BSE platform, and do not even touch our bank accounts.

Our team is always there for you !

-

We're a team of finance veterans, Chartered Accountants and CFA.

-

We're in continuous touch with the experts of the industry, to make sure your portfolio is in sync with the market scenario at all time.

Q. What are the fees that will be charged ? Are there any hidden costs ?

Q. What will happen to my money in case you shut-down ?

FAQs -

We don’t charge any fees from you, absolutely no hidden charges. We earn a small fee from financial services companies for our services.

Nothing. Your money is readily traceable and in safe hands of financial companies. We are just distributors who help you invest

We’re here to make investing smart and effortless. Our technology helps you with personalised investing recommendations and make a financial plan to achieve your life goals.

Standard disclaimer: Mutual fund investments are subject to market risks and past returns are not a guarantee of future returns.

Our take on disclaimer: Yes, investing is a risky subject and you may also lose money. But each one of us is losing more money by not participating in markets. Key to good investing is asset allocation, discipline and avoiding bad apples. After that, volatility or ups and downs is the second nature of the market. Sticking to your asset allocation and avoiding that animal called greed is the best way to ensure that your money grows and grows well.

ARN No : 145864

We're available on Call & WhatsApp on

+91-91110-06340